“Dhaka Stock Exchange building in Bangladesh financial market”

Introduction

The Dhaka Stock Exchange (DSE) stands as the core of Bangladesh’s financial system, playing a vital role in the nation’s economic development. Moreover, it serves as the main platform for investors, companies, and financial institutions to actively participate in the capital market. Over the years, the DSE has gradually evolved into a symbol of financial growth, transparency, and opportunity for millions of people across Bangladesh. In addition, as the country continues to expand its economic activities, the DSE remains a crucial institution that effectively bridges the gap between savings and investment. Ultimately, it contributes significantly to national prosperity and the overall progress of Bangladesh’s economy.

History and Background of Dhaka Stock Exchange

The Dhaka Stock Exchange was established in 1954 and began operations in 1956 under the name “East Pakistan Stock Exchange Association Ltd.” Initially, it had a small number of listed companies and limited trading activity. After the independence of Bangladesh in 1971, the exchange was renamed as the Dhaka Stock Exchange Ltd. (DSE).

From humble beginnings, DSE has grown into a modern, technology-driven stock exchange. Its journey reflects the transformation of Bangladesh’s financial sector—from a basic manual trading environment to a fully automated and digital marketplace.

Key milestones in DSE’s history include:

- 1954: Formation of East Pakistan Stock Exchange Association Ltd.

- 1962: Renamed as Dhaka Stock Exchange Ltd.

- 1976: Trading resumed after the Liberation War.

- 1998: Introduction of the Automated Trading System.

- 2013: Launch of the DSE Mobile App for online trading.

- 2018: Strategic partnership with the Shenzhen and Shanghai Stock Exchanges of China.

These developments mark the DSE’s evolution into a modern financial institution aligned with international standards.

Dhaka Stock Exchange Limited. Information

| Website | http://www.dsebd.org |

| Revenue | $7.4 million |

| Employees | 172(172 on RocketReach) |

| Founded | 1954 |

| Address | Stock Exchange Bldg motijheel C/a 9/f, Dhaka GPO, Dhaka 1000, BD |

| Phone | +880 2-9564601 |

Structure and Governance of DSE

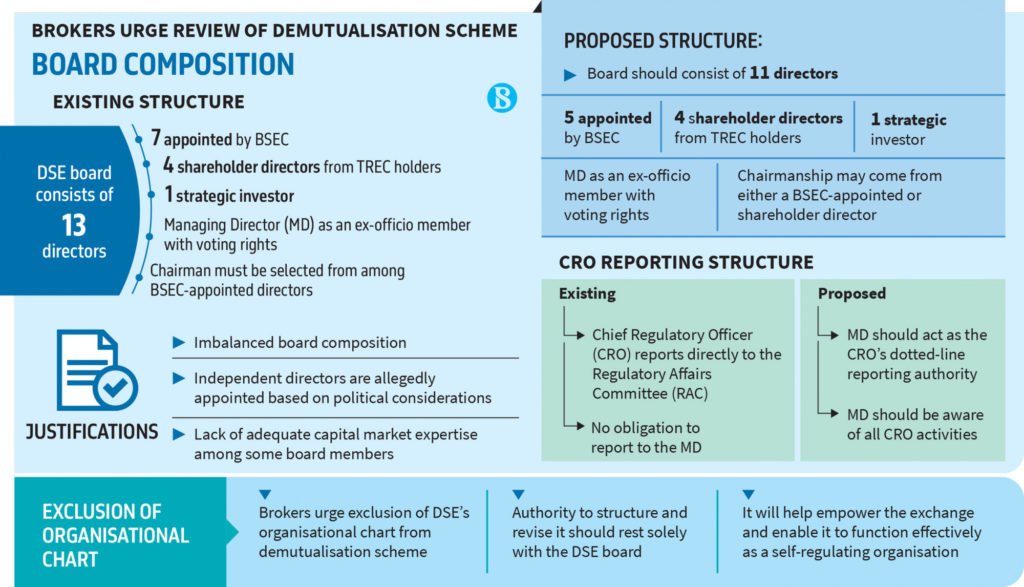

The Dhaka Stock Exchange operates as a public limited company under the Companies Act, 1994, and is regulated by the Bangladesh Securities and Exchange Commission (BSEC). The DSE board comprises directors from various backgrounds, including market experts, investors, and government representatives.

The governance structure ensures transparency and accountability. It includes:

- Chairman: Oversees the strategic direction.

- Managing Director (MD): Handles daily operations and management.

- Board of Directors: Sets policies and ensures compliance.

- Committees: Focus on audit, risk management, and regulation.

This structure allows DSE to operate efficiently while maintaining investor confidence and regulatory discipline.

Objectives of Dhaka Stock Exchange (DSE)

- Capital Raising: To provide a strong platform for entrepreneurs to raise capital for their businesses.

- Investment Opportunities: To offer investment opportunities for both small and large-scale investors.

- Transparent and Automated Market: To develop a transparent market and a fully automated trading, clearing, and settlement system for efficient and accurate transactions.

- Investor Protection: To develop a transparent market that protects the interests of all investors.

- Market Growth and Attractiveness: To attract non-resident and foreign institutional investors to the Bangladesh stock market to contribute to its growth.

- Information Dissemination: To collect, preserve, and disseminate data and information relevant to the stock market.

- Market Efficiency: To promote the orderly and healthy development of the capital market.

Functions of Dhaka Stock Exchange (DSE)

- Listing of Companies: To list public companies whose shares can be traded on the exchange.

- Trading Platform: To provide a centralized, screen-based automated marketplace for buying and selling listed securities.

- Market Administration and Control: To manage and control market activities, ensuring fair and transparent trading practices.

- Market Surveillance: To monitor activities of listed companies and surveillance the market for any malpractice.

- Information Dissemination: To announce and publish price-sensitive information about listed companies and provide market updates like daily indices and monthly reviews.

- Investor Grievance Resolution: To operate an Investor’s Grievance Cell to handle and resolve investor complaints.

- Investor Protection Fund: To manage the Investors Protection Fund to safeguard investor interests.

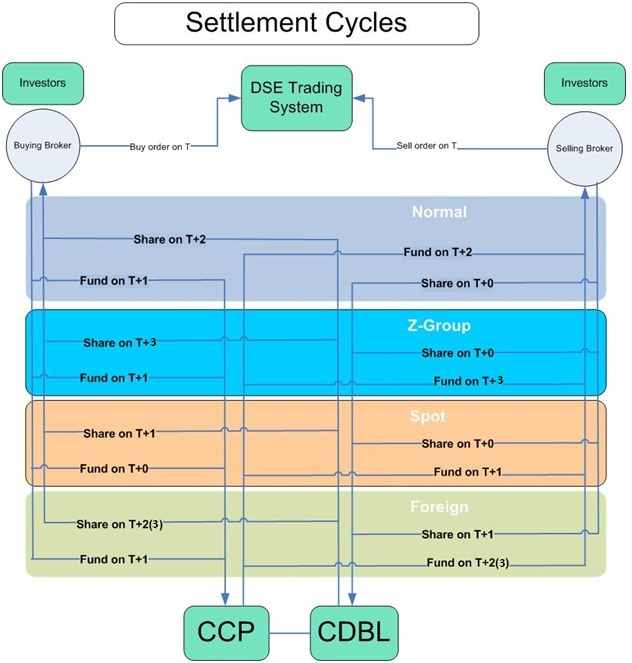

- Clearing and Settlement: To provide a robust clearing and settlement module for managing trades from entry to final settlement.

- Market Education: To provide training programs and conduct research to develop professionals and create investor awareness.

Trading System of Dhaka Stock Exchange

Trading at DSE has undergone remarkable technological advancements over the years. Initially, trading was done through open outcry, where brokers shouted buy and sell orders on the trading floor. However, since 1998, DSE has operated a fully automated trading system.

Key Features of the DSE Trading System

- Online Trading Platform: Investors can trade from anywhere using the DSE Mobile App or broker portals.

- Settlement System: The Central Depository Bangladesh Limited (CDBL) manages electronic share transfers.

- Market Timings: Trading hours

The Dhaka Stock Exchange is open for trading Sunday through Thursday between 10:00 am – 2:30 pm BST, except for holidays declared by the exchange in advance. In the month of Ramadan, the exchange is open for trading between 10:00 am – 2:00 pm BST.

There are a total of 651 Securities[8] and 397 companies[2] listed on this Stock exchange. The listing provides an exclusive privilege to securities in the stock exchange. Only listed shares are quoted on the stock exchange. A stock exchange facilitates transparency in transactions of listed securities in perfect equality and competitive conditions. Listing is beneficial to the company, to the investor, and to the public at large.

The trading indices are DSE Broad Index (DSEX), DSE Shariah Index (DSES), DSE 30 Index (DS30), CDSET.

Major Indices of Dhaka Stock Exchange

Stock market indices are essential tools for measuring performance. The DSE operates several key indices:

- DSEX (Dhaka Stock Exchange Broad Index):

The main index, launched in 2013, includes over 250 companies and reflects the overall market performance. - DS30 (Blue-Chip Index):

Comprises 30 well-performing, large-cap companies representing the most stable and financially sound firms in Bangladesh. - DSES (Shariah Index):

Contains companies that comply with Islamic finance principles, attracting investors who prefer Shariah-compliant stocks.

These indices help investors track market trends and make informed investment decisions.

Listed Companies and Market Sectors

The DSE features over 300 listed companies from diverse sectors, reflecting the diversity of Bangladesh’s economy. The main sectors include:

- Banking and Financial Institutions

- Textiles and Garments

- Pharmaceuticals and Chemicals

- Fuel and Power

- Telecommunications

- Engineering and Cement

- Food and Allied Industries

- It Sector

- Miscellaneous

- Insurance

- Mutual Fund

- Service & Real estate

- G-SEC(T-Bond)

The textile and garment sector holds a dominant position, given Bangladesh’s global reputation as a leading apparel exporter. Meanwhile, the banking and financial sector plays a crucial role in providing liquidity and investment opportunities.

Best Companies to Invest in Dhaka Stock Exchange (DSE) – Top Stocks in Bangladesh

Investing in the Dhaka Stock Exchange (DSE) offers a plethora of opportunities for both novice and seasoned investors. Identifying the best companies to invest in requires a comprehensive understanding of the market, company fundamentals, and prevailing economic conditions. Below is an in-depth analysis of some top-performing companies in the DSE that have demonstrated robust performance and growth potential.

1. Grameenphone Ltd. (GP)

Grameenphone, a leading telecommunications operator in Bangladesh, boasts a subscriber base exceeding 84 million as of September 2024. Established in 1997, it has maintained a dominant position in the market. The company’s consistent investment in infrastructure, including the introduction of 5G services, positions it well for future growth. Grameenphone’s strong financial metrics and market leadership make it a compelling choice for investors.

2. British American Tobacco Bangladesh (BATBC)

Operating since 1910, British American Tobacco Bangladesh is one of the oldest and most prominent multinational corporations in the country. The company has a diverse product portfolio with well-established brands like Benson & Hedges and John Player Gold Leaf. BATBC’s strategic initiatives, such as manufacturing agreements with international brands, are expected to bolster its revenue streams. Its consistent dividend payouts and strong market position make it attractive to investors seeking stable returns.

3. Square Pharmaceuticals Ltd.

Founded in 1958, Square Pharmaceuticals has grown to become a leader in Bangladesh’s pharmaceutical industry. The company exports products to over 36 countries and has a strong domestic presence. With continuous investments in research and development, Square Pharmaceuticals is expanding its product line and market reach. Its robust financial health and strategic growth initiatives make it a top contender for investment.

4. BRAC Bank

BRAC Bank stands out in the banking sector with its focus on small and medium enterprises (SMEs). The bank has maintained a non-performing loan ratio below 4% since 2016, reflecting prudent asset management. Its commitment to corporate governance and strategic growth plans suggest a positive outlook for potential investors.

5. BEXIMCO Ltd.

Bangladesh Export Import Company Limited (BEXIMCO) is a diversified conglomerate with interests spanning textiles, pharmaceuticals, and energy. Despite facing challenges in 2024, including financial instability and management changes, BEXIMCO’s diversified portfolio and market presence offer potential for recovery and growth. Investors should conduct thorough due diligence considering recent developments.

6. Marico Bangladesh Ltd.

Marico Bangladesh, a subsidiary of the Indian multinational Marico Ltd., specializes in consumer goods, particularly in the personal care segment. The company’s strong brand portfolio and consistent financial performance make it a noteworthy option for investors interested in the fast-moving consumer goods sector.

7. IBN Sina Pharmaceuticals

IBN Sina Pharmaceuticals is recognized for its quality pharmaceutical products and has been expanding its manufacturing capacities. With plans to launch new production facilities, the company is poised to meet increasing market demand, indicating potential growth for investors.

8. IT Consultants Ltd. (ITC)

As the owner of the largest payment platform in Bangladesh, Q-Cash, IT Consultants Ltd. plays a pivotal role in the country’s digital payment landscape. With the growing adoption of digital banking and online transactions, ITC is well-positioned to capitalize on this trend, offering promising prospects for investors.

9. Renata Limited

Renata Limited, formerly known as Pfizer Laboratories (Bangladesh) Limited, is a prominent player in the pharmaceutical and animal health products sectors. The company’s consistent growth and expansion into new markets underscore its potential as a solid investment choice.

10. Robi Axiata Limited

Robi Axiata, a major telecommunications operator in Bangladesh, has been expanding its market share through innovative services and competitive pricing. As digital connectivity becomes increasingly essential, Robi’s strategic initiatives position it well for future growth, making it an attractive option for investors.

Investment Considerations:

- Diversification: Spreading investments across multiple sectors can mitigate risks associated with market volatility.

- Market Research: Staying informed about market trends, economic indicators, and company-specific news is crucial for making informed investment decisions.

- Risk Assessment: Understanding the inherent risks associated with stock market investments and aligning them with individual risk tolerance is essential.

For real-time updates on share prices and market trends, consider visiting our Latest Share Price and Market Overview pages. Staying informed will aid in making strategic investment decisions aligned with your financial goals.

Foreign citizen how to open BO Account In Bangladesh

To open a BO account in Bangladesh as a foreign citizen, you must apply through a stockbroker or custodian with a valid passport and proof of address, such as a residency card or work permit. You’ll also need photos and signatures of yourself and a nominee, proof of income, and potentially a Power of Attorney (POA) to authorize a local representative. Some banks also offer offshore banking services for foreign individuals to facilitate opening these accounts.

1. Application Process

- Choose a Broker/Custodian: Select a Bangladeshi stockbroker or a bank’s custodial service to help you open the account.

- Submit Account Opening Form: Complete and submit the BO account opening form provided by the chosen broker or custodian.

- Complete the NITA Account Form: You will also need to complete the NITA (National ID and Tax Account) account form, which helps link your BO account to other financial services.

2. Required Documents

- Proof of Identity: A photocopy of your valid passport is required.

- Proof of Address: A document proving your address, such as a residency card, work permit, or utility bill.

- Photographs: Several passport-size photographs of yourself.

- Proof of Income: Documents like a salary statement, pay slip, or employment certificate to demonstrate your earning status.

- Nominee Information: Your nominee’s details, including 2 passport-size photos and their signature.

- Bank Information: A certificate from your foreign bank, including the routing number and your account number.

3. Opening from Abroad

- Attestation: You can open the account from a foreign country by getting your passport photocopy and photographs attested by the respective Bangladesh Embassy or High Commission.

- Power of Attorney (POA): You can give a POA to a trusted adult in Bangladesh to sign trading documents on your behalf.

4. Bank-Specific Services

- Offshore Banking: Some banks in Bangladesh, such as Jamuna Bank and Eastern Bank PLC., have Offshore Banking Units (OBUs) that can assist foreign individuals in opening accounts.

- Custodial Services: Other banks, like Dhaka Bank Securities Ltd. and BRAC Bank, offer custodial services for non-resident clients.

Opportunities for Foreign Investors in Bangladesh’s Stock Market

The stock market in Bangladesh offers various investment opportunities for foreign investors. Whether you’re looking to buy stocks in specific DSE companies or explore stock trading Bangladesh, there are ample chances to diversify a portfolio in a fast-growing economy. Investors are keen on monitoring the daily share bazar and live stock data Bangladesh to capitalize on investment opportunities as they arise.

The Bangladesh stock exchange also provides avenues for diversifying investments through various sectors. This gives foreign investors the chance to explore sector-wise gainers, top traded companies, and other high-potential areas in the market.

If you are a foreign investor or a beginner looking to enter the Bangladesh stock market, our platform offers comprehensive stock market insights Bangladesh. To start trading, visit our login page.

Countries with the largest investments in Bangladesh

For further context, the primary sources of foreign direct investment (FDI) in Bangladesh, which includes stock market investment, are:

- United Kingdom

- Singapore

- South Korea

- China

- The Netherlands

- United States

- India

- Malaysia

- Australia

Disclaimer: Stock market data can change rapidly due to shifting market conditions and investor sentiment. This is not financial advice.

Top 10 Stock Brokers by Turnover for the Month of September, 2025

Role of DSE in the Economic Development of Bangladesh

The Dhaka Stock Exchange plays a pivotal role in the economic landscape of Bangladesh. It contributes to the economy in several ways:

- Mobilizing Capital:

By enabling companies to raise funds through share issuance, DSE supports business expansion and industrialization. - Creating Employment:

The growth of listed companies generates job opportunities across multiple sectors. - Encouraging Savings and Investment:

DSE encourages individuals to invest their savings, shifting from traditional deposits to capital market instruments. - Enhancing Financial Inclusion:

With mobile and online trading, DSE brings financial opportunities to rural and urban investors alike. - Supporting Government Development Plans:

The capital raised through DSE-listed companies often funds infrastructure, energy, and technology projects aligned with the national vision for growth.

Challenges Faced by Dhaka Stock Exchange

Despite its success, the DSE faces several ongoing challenges:

- Market Volatility:

The DSE has experienced periods of rapid rise and sudden declines, affecting investor confidence. - Lack of Awareness:

Many small investors lack adequate knowledge of stock trading, leading to impulsive decisions and losses. - Limited Institutional Participation:

The market is still dominated by retail investors, making it vulnerable to speculation. - Corporate Governance Issues:

Some listed companies have been criticized for weak transparency and irregular disclosures. - Regulatory and Political Factors:

Changes in government policy or economic conditions can impact market stability.

Addressing these challenges through stronger regulation, financial education, and institutional participation is vital for sustainable growth.

Recent Developments and Reforms

In recent years, the DSE has introduced several reforms to modernize the market and build investor confidence:

- Strategic Partnership with Chinese Stock Exchanges (2018):

The partnership with Shenzhen and Shanghai Stock Exchanges brought in technological and strategic expertise. - Introduction of SME Board:

A separate platform for small and medium enterprises (SMEs) to raise funds and grow their businesses. - Launch of DSE Mobile App:

Simplified online trading and expanded access for retail investors. - Enhanced Surveillance and Automation:

Real-time monitoring systems ensure transparency and reduce market manipulation. - Investor Education Programs:

DSE has increased training sessions and awareness campaigns for new investors.

These initiatives have made DSE more resilient, transparent, and aligned with global financial standards.

Investment Opportunities in DSE

The Dhaka Stock Exchange offers a variety of investment options for both local and foreign investors:

- Equity Shares:

The most common form of investment—buying ownership in listed companies. - Mutual Funds:

Pooled investment vehicles managed by professionals, offering diversification and reduced risk. - Corporate Bonds:

Fixed-income securities providing steady returns over time. - Exchange-Traded Funds (ETFs):

Though still in development, ETFs represent a future opportunity for diversified market exposure. - SME Board Investments:

For investors interested in supporting small and growing businesses.

The DSE is increasingly becoming a hub for diversified investment options that appeal to both risk-takers and conservative investors.

Future Prospects of Dhaka Stock Exchange

The future of the DSE looks promising as Bangladesh continues its journey toward becoming a middle-income and eventually a developed country. Key factors contributing to DSE’s future growth include:

- Technological Advancement:

Continuous digitalization will make trading faster and more transparent. - Increased Foreign Investment:

Economic stability and growth attract global investors seeking emerging market opportunities. - Expansion of Product Range:

Introduction of derivatives, ETFs, and more corporate bonds will enhance market depth. - Sustainability and ESG Investing:

Growing focus on environmentally and socially responsible investments. - Economic Growth:

As Bangladesh’s GDP continues to rise, corporate profitability and investor participation are likely to increase.

Overall, with continued reforms and innovation, the DSE is positioned to play a larger role in South Asia’s financial ecosystem.

Conclusion

The Dhaka Stock Exchange (DSE) is not just a trading platform—rather, it is the heartbeat of Bangladesh’s financial market. Over the decades, it has steadily evolved into a powerful engine that drives industrial growth, investment, and economic development. Furthermore, with continuous reforms, technological innovations, and strong global partnerships, the DSE is progressively moving toward becoming a world-class exchange.

For investors, the DSE represents not only opportunity and growth but also meaningful participation in the country’s remarkable economic story. As a result, it has become a symbol of trust and progress within Bangladesh’s financial sector. Moreover, as Bangladesh continues to rise on the global stage, the Dhaka Stock Exchange will undoubtedly continue to empower businesses, strengthen financial inclusion, and shape the future of the nation’s economy. Ultimately, the DSE stands as a pillar of stability and innovation in Bangladesh’s journey toward sustainable economic success.

“A very insightful topic highlighting the vital role of the Dhaka Stock Exchange in shaping Bangladesh’s economy.”